The Latest Industry Trends and Insights

Carbon tariffs are here! Industrial and commercial distributed photovoltaic power stations have become a new and essential demand

The implementation of the EU Carbon Border Adjustment Mechanism (CBAM, also known as "carbon tariffs") is getting closer and closer, and there have been key new developments recently. The European Parliament's Committee on Environment, Public Health and Food Safety (ENVI) has officially passed the European Carbon Border Adjustment Mechanism (CBAM) agreement, and the EU's Carbon Border Adjustment Mechanism (CBAM) has received majority approval, with a specific effective date of October 1, 2023.

After the implementation of this regulation, the cement, steel, aluminum, and fertilizer industries will face pressure to pay carbon tariffs. Compared to the high carbon tariffs borne by the export sector, many enterprises are more inclined to seek low-cost carbon reduction measures in the production sector, and building photovoltaic power stations has become the main choice for carbon reduction.

Multiple industries are affected and may become green trade fortresses

Carbon tariffs, also known as carbon border regulation mechanisms or carbon border regulation taxes, refer to countries or regions that strictly implement carbon reduction policies and require them to pay (refund) corresponding taxes or carbon quotas when importing (exporting) high carbon products. According to regulations, as long as the carbon pricing (possibly carbon tax, carbon fee, or recognized carbon trading system carbon price) of the production site is lower than the EU ETS carbon price, once imported into the EU tariff area, CBAM vouchers must be purchased to make up for the difference. Therefore, "carbon tariffs" can also be referred to as CBAM.

According to the CBAM draft rules, cement, steel, aluminum, and fertilizers, among others, will be included in the industry as the first batch and will take effect in the transition phase from October 1, 2023 (no fees are required during the transition period, but carbon emissions, paid carbon prices, and other carbon information must be provided), and will fully take effect on January 1, 2026. Importers from EU countries are required to declare the specific quantity of goods and carbon emissions imported in the previous year each year. The EU will adjust the purchase and issuance of CBAM certificates based on the declared quantity. For export enterprises, this will inevitably increase production costs, weaken product competitiveness, and even eliminate some high polluting and high-energy consuming enterprises.

Taking the steel industry as an example, based on China's average carbon emissions per ton of steel of 1.8 tons, the first stage of 1.3 tons of free quota, and the average carbon price in Europe of 80 euros/ton in 2022, China's steel exports to the European Union will increase the carbon tariff cost by an average of 300 yuan/ton, accounting for about 7.5% of the proportion of steel prices. After the full expiration of the free quota by 2032, The cost of CBAM will further increase to 1050 RMB/ton. The affected trade volume of the steel industry is about 16 billion yuan, with an estimated total tax amount of 2.6-28 billion yuan.

In terms of the aluminum industry, the affected trade volume is about 9 billion yuan, with an estimated total tax amount of 2-2.3 billion yuan. Due to the high carbon emissions of about 12 tons from raw aluminum production, the proportion of carbon tariffs generated by it far exceeds that of steel, reaching 29-33%.

If it is further expanded to downstream industries in the future, after the carbon tariff takes effect, domestic enterprises will face the risk of goods being stranded and unable to export if they do not do a good job in carbon footprint tracking management and carbon reduction measures throughout the entire lifecycle.

With the advent of carbon tariffs, "photovoltaic+" has become a new "essential demand"

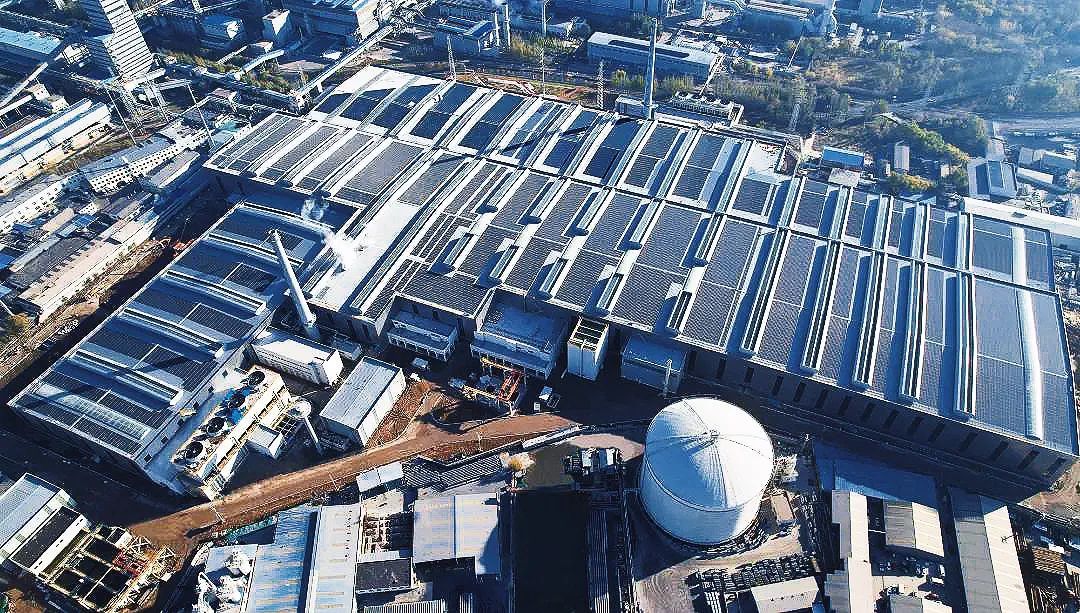

In 2022, the newly added grid connected capacity of industrial and commercial photovoltaic power stations increased by 236% year-on-year. Some leading domestic enterprises have taken the initiative to build zero carbon industrial parks or install photovoltaic panels on the roofs of factory buildings, so as to achieve low-carbon emissions in the product production chain.

Based on 2022 data, a 1MW industrial and commercial photovoltaic power station generates approximately 1 million kilowatt hours of electricity annually. Calculated based on China's 2021 carbon emissions of 828 grams, it can reduce carbon emissions by 828 tons and save approximately 480000 RMB in carbon tariffs. From the above data, it can be seen that building photovoltaic power stations can effectively reduce carbon tariffs for enterprises. The efficiency, low-carbon, safety, and low cost of photovoltaic power generation technology have made it the most economical power source in countries around the world.

For industrial and commercial distribution, most parks have rich scenes and non-standard buildings, which are more dispersed than centralized ones. As a leading brand of full lifecycle energy ecological solutions, the Chinese government and enterprise regional department empowers thousands of industries and creates an excellent brand of green energy in the industrial and commercial industry that integrates safety, efficiency, aesthetics, and digital integration. With the aim of reducing electricity costs and reliability as the foundation, we have launched industry customized and multi scenario integrated solutions, perfectly matching industry needs based on industry characteristics and pain points.

English

English

Location:

Location: